The electric revolution has a distinctly Chinese accent. With Chinese companies now controlling over 50% of global EV sales, their dominance extends far beyond mere market share into the very heart of battery technology that powers this shift.

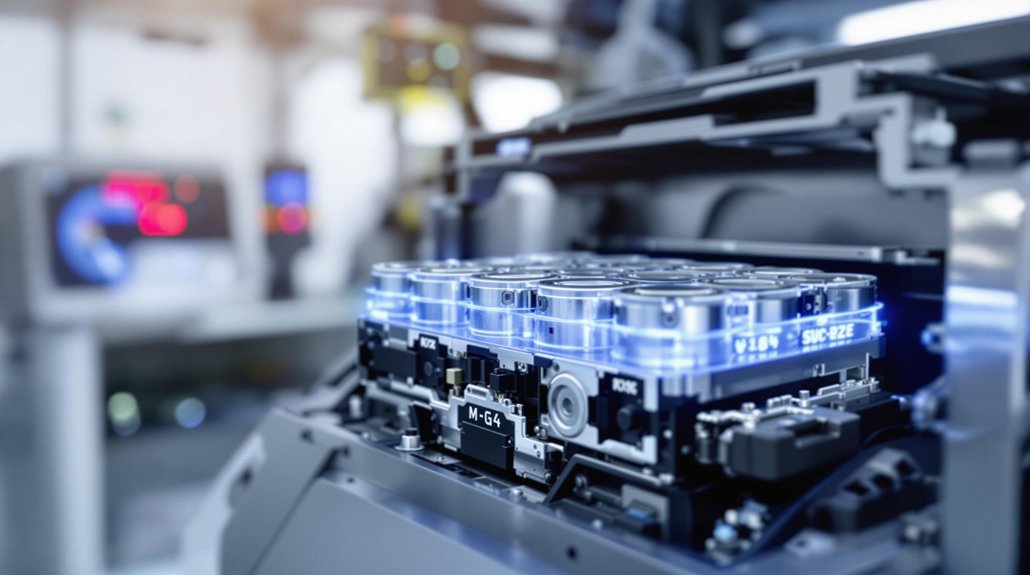

Battery giants CATL and BYD collectively command 55% of the global EV battery market, transforming what was once a Western-led industry into an arena where Chinese innovation sets the pace.

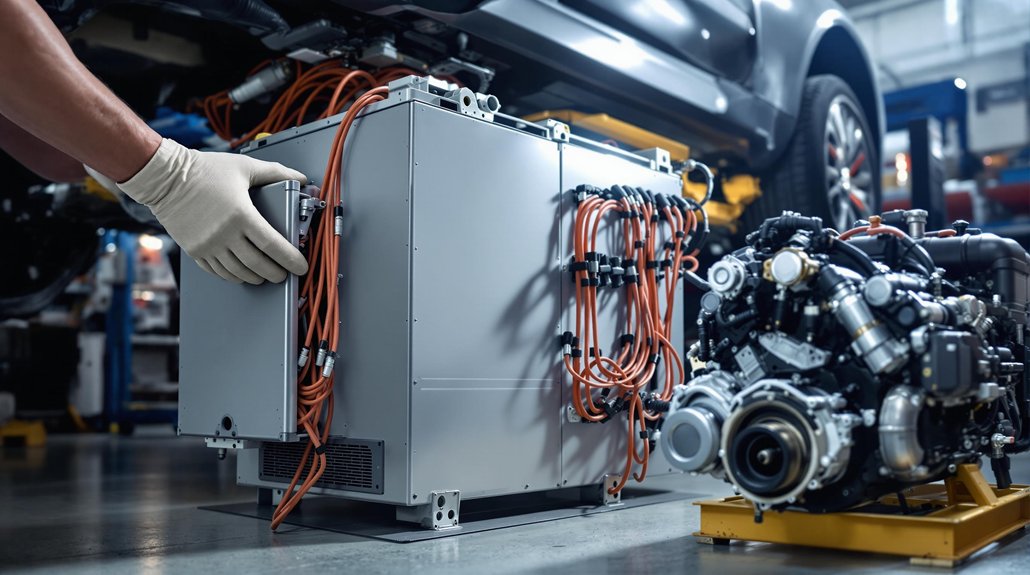

The latest breakthrough in lithium iron phosphate (LFP) battery chemistry has yielded remarkable advancements in energy density, pushing range capabilities beyond 330 miles per charge. I’ve tracked these developments closely and can confirm that these cells maintain performance while greatly reducing costs compared to traditional nickel-based alternatives.

The phosphate-based chemistries excel in safety metrics and cycle life, often exceeding the incredible milestone of 3,000 recharge cycles under ideal conditions, with some designs potentially offering lifecycles exceeding one million miles.

China’s strategic advantage stems from its near-total control of critical mineral processing. The country refines more than 80% of global lithium-ion electrodes and battery cells, while processing most of the world’s lithium, cobalt, and graphite supplies. Chinese manufacturers have established major export channels to Latin American markets where they now dominate EV sales.

Virtually all LFP cathode materials worldwide originate from Chinese facilities, creating an almost insurmountable supply chain advantage.

This industrial might hasn’t emerged by accident. The Chinese government has invested approximately $230 billion in EV-related subsidies through its “Made in China 2025” initiative, coupled with establishing nearly 50 specialized graduate programs in battery chemistry and metallurgy.

The results speak volumes: almost half of new vehicles sold in China are electric or plug-in hybrids.

Recent policy shifts toward protecting this technological edge include export restrictions on advanced battery manufacturing technologies. As of July 2025, licensing requirements will govern the transfer of key production technologies abroad.

For global automakers, the message is clear—Chinese battery technology has become the essential foundation of affordable, long-range electric mobility, and access to it will increasingly come with strings attached.

The European market has experienced a significant shift in consumer preference with Chinese EV brands reaching 5% market share in April 2025, demonstrating the growing global influence of Chinese electric vehicle technology.